A Crisis Crash or Bear Market?

By Michael Coolbaugh, Chief Investment Officer

*The following is a portion of our ‘Weekly Observations’ report that was published to clients on April 8, 2025.

Could we finally see the relief rally that everyone has been clamoring for over the past several weeks? I think the odds are pretty good for several reasons. First, the VIX Index briefly printed above 60 yesterday morning, a level that is extremely hard to sustain outside of a full-blown crisis. For reference, the VIX Index hit 85 at the point of peak panic during the Covid crash. Second, our metrics are once again flashing deep oversold conditions – both on a breadth and momentum basis.

Third, #stockmarketcrash is trending on Twitter. This is the equivalent of CNBC running their ‘Markets In Turmoil’ segments after a dramatic drawdown in equity prices. These anecdotal moments generally tend to provide pretty solid rally opportunities. Fourth, the Trump administration has clearly made a pivot towards a softer tone that began with the global bloodbath Sunday evening.

Kevin Hassett was the first to come out yesterday morning in which he said, “It’s time to ratchet down the rhetoric a bit.” Then stories began to swirl about Treasury Secretary Scott Bessent flying to Florida Sunday evening to urge Trump to soften his tone and provide markets with a clearer image of his ‘end game’ for the tariff regime. All day yesterday, we heard from Bessent and Trump that negotiations were beginning and “approximately 70 countries have called, seeking negotiations.” And while the ultra-hawk Peter Navarro insists “this is not a negotiation”, all the rhetoric coming from Trump and Bessent suggest it is exactly that.

This market has been desperate for any positive news. Yesterday morning, a false headline, that suggested that Trump would pause the April 9 reciprocal tariffs by 90 days, sent equity futures soaring. It was only after the White House refuted that news that equities quickly reversed course and settled on a nearly-flat close. But here’s the interesting part of all the recent drama…

If the goal of all this carnage was to force interest rates lower, this experiment has failed miserably. In fact, long-term interest rates are now higher than they were on the close of the day before “Liberation Day”. That’s right, as of yesterday’s close, the S&P 500 Index has fallen -17.6% from its closing high on February 19th. And what do we have to show for all that destruction of wealth? A 10-year yield that has gone from 4.53% to 4.21%.

I mean, if this administration wants to get 10-year yields below 4% sustainably, and we extrapolate this current pace; it’s truly terrifying to think just how far equities would need to fall to achieve this objective. To give you a reference of just how painful this can be – the S&P 500 Index ETF (SPY) is down -7.6% month-to-date, if we incorporate today’s pre-market. The iShares 20+ Year Treasury ETF (TLT) is down -1.24% for the month. Even gold, everyone’s favorite safe-haven of late, is down -3.7% MTD.

To me, this was a two-phase panic. The first was Trump’s announcement of reciprocal tariffs on Liberation Day. The market action immediately following actually saw a nice dispersion in performance where countries that were left relatively unscathed (a lot of Latin America and the UK) performed quite well, with some posting strong gains. But the second phase was when China announced its retaliatory measures. This sent global markets into a full-blown liquidation event. Why do I believe it was a liquidation event?

It was primarily the action in gold, but some of the mini flash-crashes in the EU Defense industry suggested this, as well. You see, in a true liquidation event, everything gets sold. It doesn’t matter if it’s a safe-haven or what the fundamental backdrop is, large investors drastically reduce risk – some may even be facing margin calls – and that prompts indiscriminate selling in search for cold hard cash.

That’s precisely what we saw unfold over the past several days. Gold fell ~7.3% in three sessions. And yesterday, with global markets melting down in the overnight session, we saw a massive reversal across the Treasury complex. 30-year US Treasury bond futures saw an intraday reversal of >5%. The US 2-year yield went from a low of 3.446% to a high of 3.86%.

Again, the concern here is the lack of true safe-havens, while equities still remain relatively rich. With the VIX Index still sitting >40, put options will provide very little protection – the blowout in implied volatility has already occurred. Your traditional safe-havens are not protecting portfolios. If we see a renewed bout of weakness, this means one thing – further de-risking is the only option.

In fact, analysts over at Citi highlighted these potential issues on Friday stating, “We see signs of market stress in areas including cross-asset volatility, high-yield spreads, and US Treasury liquidity.” What a prescient call!

To me, if conditions worsen from here, I don’t think it’s too far fetched to believe the Federal Reserve will step in to bolster liquidity in the Treasury market. Yes, this would be “QE”, although I’m sure they would call it something else so as to avoid the appearance of easing. Something similar to their “Non-QE QE” from the 2019 Repo Crisis.

And that’s where the tricky part comes in now that we’ve rallied >8% off the Sunday night lows. Could we see more of a relief rally? Sure, especially for a market that’s been so desperate for any sliver of positive news. The other factor at play here is precisely what I mentioned above with the VIX Index >40. If things calm down, even for a day or two, this could spark an urgent unwind in protection (monetizing put options), which would place downward pressure of volatility and spark additional buying of equities.

But as I laid out in our market update from last Thursday, a furious rally likely only presents another opportunity for selling. And here’s why I believe as such…

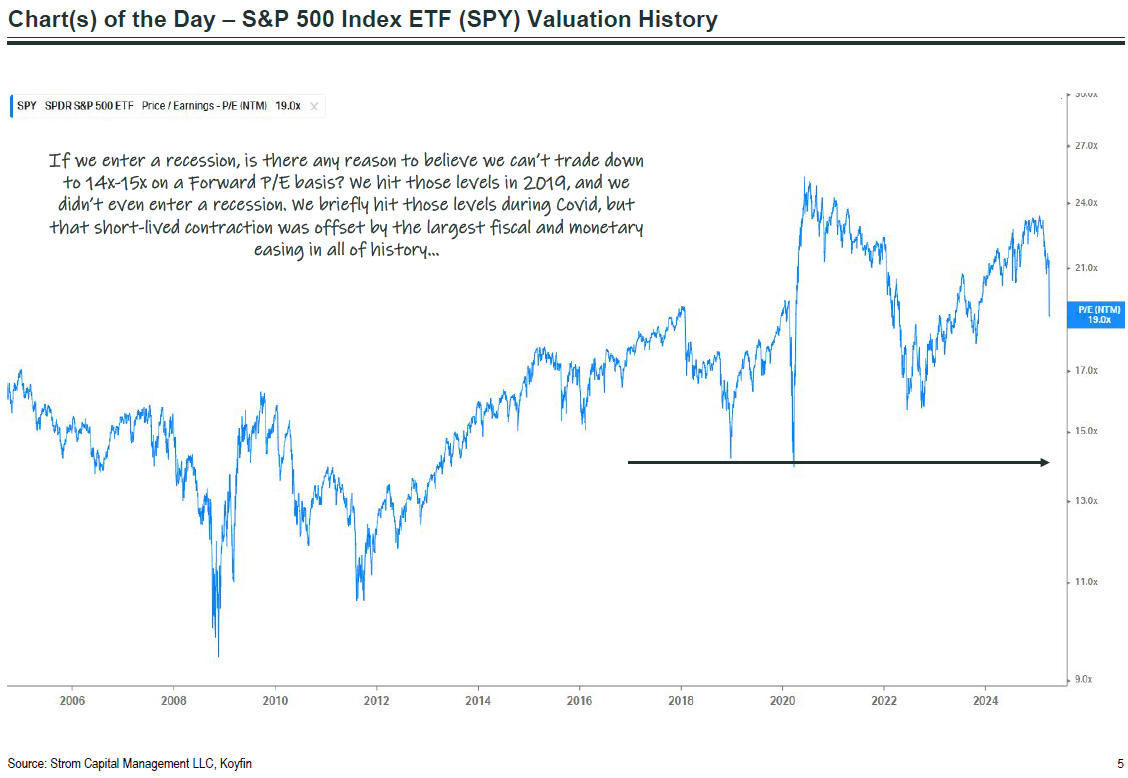

As of yesterday’s close, the S&P 500 Index Forward P/E ratio fell to 19x. Remember, this is one of the most significant, reworkings of the global economy since the early-1900s. At a Forward P/E of 19x, we aren’t even remotely close to even the 2022 bear market lows (~15.8x), and that’s when we weren’t staring at a high probability of a global recession.

Even with the recent softening in rhetoric, the administration has made very clear that tariffs are here to stay. While other countries have offered to cut their tariffs on the United States, Trump has been very clear that those adjustments are simply not enough. Some countries will make efforts to balance trade and could see a lowering of their tariffs. But one thing has been abundantly clear, there is zero room for negotiation with China. With China and the United States locked in a Mexican standoff, there’s zero question of what that will do for the world’s two largest economies.

Anecdotally, I saw a post from a business owner yesterday evening. He stated that a product they need to import cost his business ~4,000 in tariffs in 2024. Today, that figure stands at ~$100,000. What’s worse is that he needs to pay that tariff fee upfront before he can even take delivery and then try to sell that product. To think this won’t have a drastic impact on investment or demand here in the United States is pure fantasy. Reshoring supply chains, building out factories (not to mention if we even have the labor to support such industries) takes years, not months.

So, yes, I think we are seeing clear signs of a softening in rhetoric from the Trump administration that could see tariffs on some countries lowered from the currently draconian levels. But I also believe tariffs, in large part, are here to stay for the sole reason that they view it as a source of revenue to trim the deficit.

What’s hilarious about the bullish arguments of tax cuts is that the two are essentially offsetting to each other. There were even headlines yesterday that stated the administration was looking at possible tax breaks for US exporters, as a way to soften the impact of trade wars. Spoiler – if we’re going to expand the deficit via tax cuts, then the revenue implications of tariffs is, at best, a neutral maneuver. In other words, it won’t do anything to the deficit. And, no, Elon Musk’s DOGE efforts won’t even make a scratch on the surface of government spending.

I’d argue that the strongest bullish argument is that tariffs broadly get ratcheted down to the ~10% level, while Republicans jam through tax cuts. That likely reduces the odds of a major recession here in the United States and puts downside valuation targets within clearer view. Only problem is, there are growing signs of divide for Republicans. As the top Republican on the House Budget Committee said, “the Senate’s approach to spending cuts was ‘unserious and disappointing’.

To me, the hopes of extending tax cuts won’t move nearly as fast as what we’re about to see with a slowing of the global economy. Even the more dovish Treasury Secretary Bessent has said that negotiations with other countries on tariffs will likely drag on into June, and possibly even longer. In the meantime, the current tariff rates will go into effect tomorrow and I’ve already highlighted what that means to many small- and medium-sized businesses.

So, yes, based on technical factors (falling volatility with a calming of a global liquidation event), we could see equities stabilize and even rally a bit more than the +2.45% we see this morning. But seeing as the interest rates complex is giving very little to no relief for the economy, I struggle to see the case for a resumption of a raging bull market. Even the Fed has insisted that they are in wait-and-see mode, suggesting they will yet again be late to offset any true destruction.

If things get really wild, we could probably see a violent rally – based off short covering and then FOMO chasing that people might have missed the bottom of a major bull market – up towards the 5,500 level in the S&P 500 Index. Now that #stockmarketcrash is trending on Twitter and Bill Ackman has been on a tweet tirade about a ‘economic nuclear winter’, the table seems set. Reminder – back in late 2024, he was touting President Trump as the most bullish pro-growth President in his entire lifetime.

But if we do, I believe that would be an excellent opportunity to be selling aggressively, unless of course, we see a major change to the current dynamics.